Tariffs on U.S. Importers | Tariffs Are Taxes

It’s no secret that much of the clothing and footwear you purchase is imported. We are a highly globalized industry, and your most trusted brands have sophisticated and responsible supply chains across the world. What is surprising is that American brands and their consumers are footing a tariff burden that is outdated, regressive, and even misogynistic!

Did You Know?

- The U.S. apparel, footwear, and accessories industry directly employs 3.5 million American workers in good paying jobs in design, R&D, compliance, marketing, and retail in every corner of the United States.

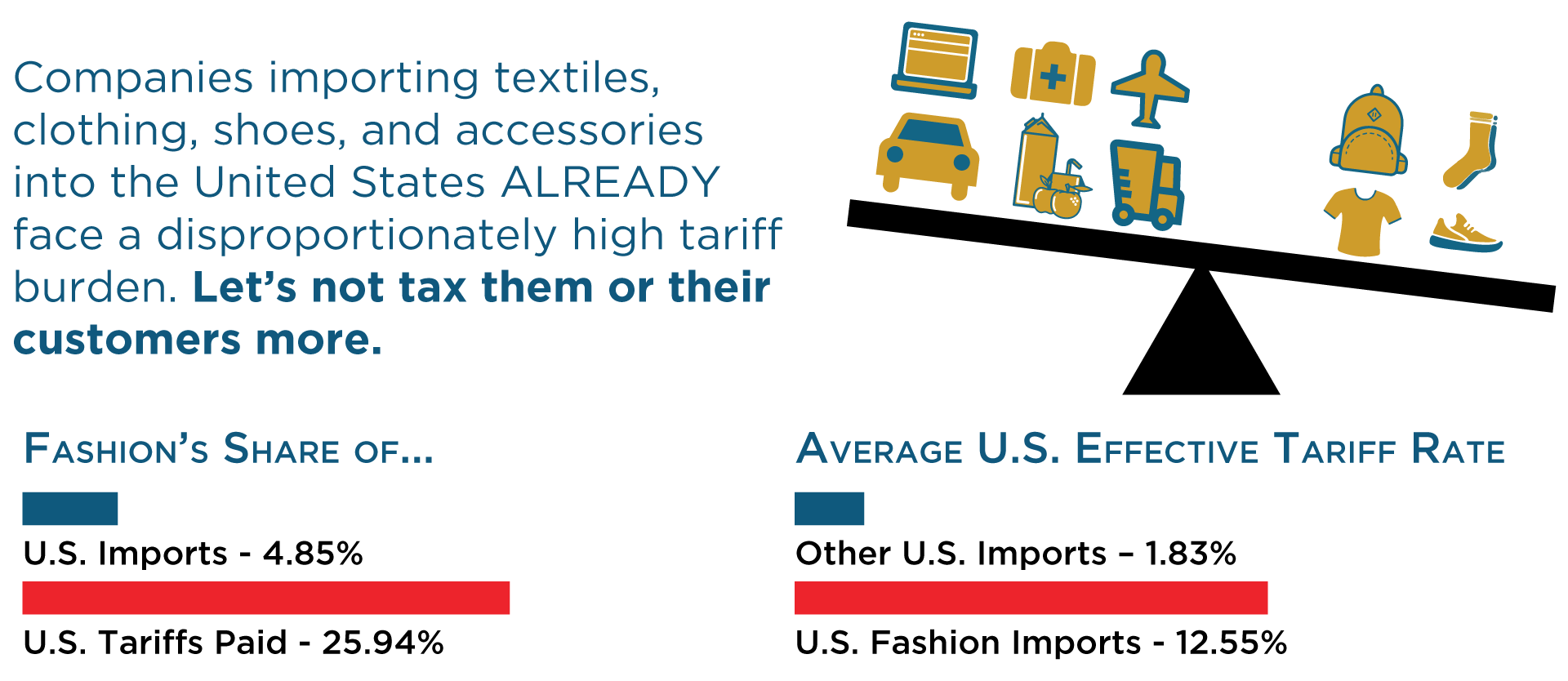

- The average effective tariff rate on both footwear and apparel is over five times higher than on all other U.S. imports.

-

Fashion’s share of total U.S. imports is about five percent while fashion’s share of total duties is more than 25 percent.

-

Many are surprised to learn that there is STILL an extra burden borne by woman due to a “pink tariff” - U.S. tariff rates on women's clothes and shoes are about three percent higher on average than tariffs on men's clothes and shoes.

- The disparity means an extra cost of about $2 billion+ for females (or more precisely, buyers of women's clothes and shoes) as of 2018.

Learn more about the massive tariff burden we face

Learn more about the massive tariff burden we face [PDF]

Although fashion’s supply chains have evolved considerably over the past decade alone, the tariffs governing that supply chain are still anchored in the policies that led to the Great Depression.

Fashion tariffs are also regressive, not only by disproportionately taxing the disposable income of lower income American more than their richer counterparts, but also by charging higher tariff rates on product that they buy in greater quantities than wealthier Americans. For any conversation regarding new tariffs, it makes sense to address the longstanding gender and income discrimination.

Tariffs By State:

From Arizona to Texas to Pennsylvania, tariff rate increases — like those in 2018-2019 due to Section 301 tariffs on China, and coming soon due to recent tariff announcements and ‘reciprocal tariff reviews’ — raise prices for consumers of many everyday items. Dig into our analysis of 2024 data, state by state, with these one-pagers.

How Can Tariffs Be Strategic?

Tariffs, thoughtfully applied for strategic ends, can play an important role in advancing U.S. economic and security policies. But across the board tariffs, particularly on fashion articles and materials, and other items that are not made at scale in the United States, only fuel inflation. We look forward to a renewed and invigorated conversation on smart tariff and trade policy, not only to make sure we can fix a centuries old problem, but also to ensure we have the tools to keep us competitive, fashionably so, well into the coming decades.

Read on with recent comments, testimony, and follow along with #TariffsAreTaxes.